During FY14, State Bank of Pakistan spent a huge amount of Rs 6,146 million on the printing of currency notes compared to the expense of Rs 5,635 million during the previous year ; an increase of 9 percent.

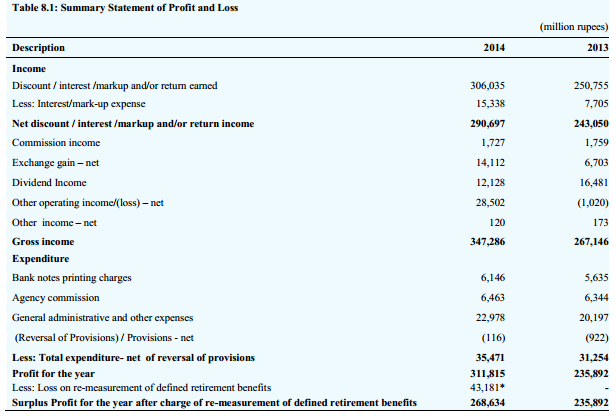

Special Report by J. Choudhry/KARACHI: For the financial year ended June 30, 2014, surplus profit of the Bank stood at Rs 268,634 million, showing 14 percent increase compared to the profit of Rs 235,892 million in the preceding year.

The increase is mainly attributable to higher discount, interest/markup and/or return earned and increases

in other operating income partly offset by the accumulated loss on re-measurement of defined

retirement benefits (due to revision in International Accounting Standard 19 – Employee Benefit).

The Bank earns discount income on its holdings of Market Treasury Bills (MTBs), whereas interest/markup and return is derived on the foreign and domestic financial assets held by the Bank.

The gross income under the head increased by Rs. 55,280 million, posting an increase of 22 percent compared to the last year. The increase is mainly attributable to increase in quantum of lending.

Interest/markup expenses are incurred on borrowings from International Monetary Fund, deposits of international organizations and foreign central banks and payable currency swap arrangement. Expenditure under the head increased by 100 percent as compared to previous year due to increases in borrowings under currency swap arrangements and expense on securities sold under agreement to

repurchase. This increase is partly offset by decrease in expense on IMF borrowings.

Commission Income

The Bank derives commission income from management of instruments of public debt, Market treasury bills, prize bonds, national saving schemes and government securities as well as issuance of drafts and payment orders.

The commission income during FY14 decreased by 2 percent and stood at Rs 1,727 million compared to Rs 1,759 million during the previous financial year.

Exchange Gain – Net

The net exchange gain / (loss) arise from Bank’s foreign currency assets and liabilities. The exchange gain mainly arises due to depreciation of PKR vis-à-vis foreign currencies particularly US$ and SDR. Specifically, the foreign currency assets of the Bank are mainly denominated in US$ whereas the foreign currency liability exposure is mainly denominated in SDRs. Accordingly, the depreciation of PKR vis-à-vis US$ results in exchange gain to Bank and vice versa, while the depreciation of PKR vis-à-vis SDR results in exchange loss and vice versa.

The net exchange gains amounted to Rs. 14,112 million during the FY 2013-14 as against the

income of Rs 6,703 million during the previous financial year marking increase of Rs. 7,409

million. The increase was mainly due to decline in exchange loss payable to IMF amounting to Rs. 10,319 million and SDR amounting to Rs. 1,100 million due to strengthening of PKR vis-à-vis SDR. However, this is partly offset by decrease in exchange gain from foreign currency placements, deposits and other assets amount to Rs. 3,980 million, forward covers under Exchange Risk Coverage to Rs. 21 million during the current year from previous year again due to strengthening of PKR.

Dividend Income

The State Bank holds the equity investments in banks and financial institutions. The breakup of

dividend income on Bank’s listed and unlisted equity investments as of June 30, 2014. The dividend income of the Bank decreased by Rs 4,353 million during the current financial year which is 26 percent lower than the income in the previous financial year.

Other Operating Income / (loss) – net

During the year under review, the gain of Rs 28,502 million was recorded under this head against the

loss of Rs 1,020 million in the previous financial year. The main reason for increase in Bank’s net

other operating income in the current year as compared to previous year is the gain on sale of shares

of UBL i.e. Rs. 31,186 million.

Expenditure

The total expenditure (including reversal of provisions against impaired assets) amounted to Rs.

35,471 million as against the expenditure of Rs 31,254 million during corresponding year; an increase

4,217 million. An analysis of main elements of Bank’s expenditure is given as under;

Bank Notes Printing Charges

During FY14, expense under this head stood at Rs 6,146 million compared to the expense of Rs 5,635

million during the previous year ; an increase of 9 percent.