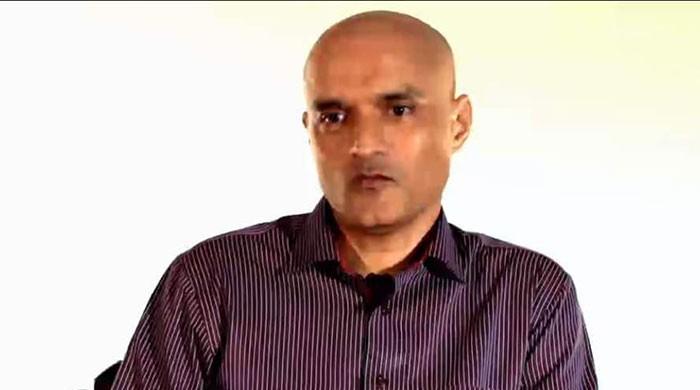

I am Commander Kulbhushan Sudhir Jadhav. Number 41558 Zulu of the Indian Navy

I am a commissioned officer in the Indian Navy. And my alias name was Hussain Mubarak Patel. And I was basically; I’d visited Karachi on 2 occasions in 2005 and 2006 for basic intelligence gathering on Naval installations and subsequent detail. Basically gathering information on the landing sites around Karachi and various naval vessels or whatever I could gather about the navy.

The RAW officials had started sniffing that the Modi government will be in power by 2014. So I was inducted and my services were handed over to Research and Analysis Wing (RAW). And the aim was to see that all the activities around the Mekran Coast and Karachi and Balochistan Interior. Turbat and Quetta were to be organized and nicely coordinated.

Subsequently, me along with Anil Kumar had a meeting with Alok Joshi. Where in the plans and the finalization of the activities along the Mekran Coast and Karachi were finalized. I was stationed in Chahbahar, The Iranian Port City under a fictitious name “Hussein Mubarak Patel” and I was running a business there “Kaminda Trading company”. It was a discreet non embassy based operation exclusively meant to conduct meetings with Baloch insurgents and terrorists. The aim of these meetings was always to see that the Aims and the Targets of RAW to conduct the various terrorist activities within Balochistan are conveyed properly to the insurgents and any kinds of requirements of them are conveyed back to the RAW officials.

My purpose of this time visit to Pakistan was to establish and meet the basic leadership of Baloch sub nationals, the BLA or the BRA and establish and Infiltrate around 30 to 40 RAW operatives along the Mekran Coast for Operations along with Baloch sub nationals and miscreants or Terrorists.

The aim was to have RAW operatives on field so that they could facilitate and help the Baloch sub nationals in carrying out precision targets to be carried out. Precision, I would say sort of a military sort of a connection to the entire Operation.

Balochistan doesn’t have a movement on the sea, so the aim was to raise within the Baloch sub nationals a sea front, so that the activities could be properly coordinated from the sea side and subsequently taken on further inwards, may be Quetta or Turbat or maybe interiors of various places.

The subsequent activities which were then handed over by RAW when I subsequently started working for Research and analysis wing, the main aim was focused to Balochistan and the Karachi region. The idea was to see to it that the sub nationals with in this region were facilitated and supported financially and with arms and Ammunition, weapons and some kind of maybe man and material movement also across the coast.

So me being a naval officer I was given the task of seeing that how they could be landed across the Mekran coast, between Gwadar, Jewani or whichever suitable points were there across this belt. And the main ideology beyond this was that the economic and the various activities which go along the CPEC region between Gwadar and China had to be distorted and disrupted and some destabilized so that the aim was to just basically raise the level of insurgency within Balochistan and the Karachi region.

Research and Analysis Wing through Mr Anil Kumar has been abetting and financing and sponsoring a lot of activities within Balochistan and Sindh. The entire Hundi and Hawala operations are undertaken from Delhi and Mumbai via Dubai into Pakistan and during one such important transaction was the 40,000 dollars which was transferred to Baloch sub Nationals via Dubai. Also the finances which are coming into Balochistan and Sindh for various anti National activities are coming through consulates in Jalalabad and Kandhar and the Consulate in Zahidan. These are very important consulates which are used by Research and Analysis Wing to transfer dollars into the Balochistan movement.

And one such instance was where I was directly involved and I was observing the transaction was when 40,000 Dollars were recently transferred from India via Dubai to one such Baloch National operative within Pakistan.

Research and Analysis Wing and Mr Anil Kumar on behalf of RAW had been sponsoring regularly the various terrorist activities within Pakistan. Especially Hazara Muslims, Shia Muslims who move around on pilgrimage between Iran, Afghanistan and Pakistan were basically to be targeted and killed. They were already being done, it was being done but the level had to be raised to the very high level so that the movement completely stops.

Then the targets on various workers of FWO who were conducting construction of various roads within Balochistan and the third major activity was the IED attacks which were being carried out by the Baloch sub nationals within Quetta, Turbat or various other cities of Balochistan.They were being directly sponsored by RAW.

Mr Anil Kumar has been sponsoring sectarian violence across Sindh and Balochistan and also sponsoring various assassinations across this same region so that instability or some kind of fear is set into the mindsets of the people of Pakistan, and in one such process SSP Chaudhary was assassinated. This was a direct mention by Mr Anil Kumar to me.

The various financing which subsequently happened for the TTP and various other Afghan anti Pakistani terrorist groups led to the attack by TTP on one of the Mehran Naval Bases in which a lot of damage was cost to the Pakistani Navy. Other sort of radar installation attack, the Sui pipeline gas attack, then attacks on civilian bus Stations where some I suppose Pakistani Nationals were being targeted by Sub Nationals and murdered and massacred so that a sort of disruption in the CPEC is done that was being funded and directly supported by Mr Anil Kumar. He wanted it to be raised to the next level so that complete disruption and complete stoppage of the Economic corridor between Gwadar and China is achieved.

One of the operations which was being planned by RAW officials along with Baloch insurgents was a military style attack on Zahidan Pakistani consulate. The aim was to either attack it with a grenade or some kind of RPG or IED attack or then try to harm the consulate General or some kind of vicious attack on the Pakistani consulate in Zahidan. It was being militarily planned, the RAW officials were involved in Iran and the Baloch Sub Nationals who were supposed to carry out the attack or facilitate the entire process were being involved and I was well aware of the plan which was being conducted and how it was being planned.

RAW was sponsoring the setting up of the modern website, a new website which was being already run through Nepal which the Balochistan movement was carrying on, on the Cyber world and the creation of the website, the previous maintenance of the already existing website was being handled by the Research and Analysis wing from Nepal, Kathmandu which was luring people from within Pakistan for various activities to be carried out in the future.

This time while crossing over into Pakistan I travelled all the way from Chahbahar in a private Taxi along with Rakesh to the Iranian Pakistan border near Sarawan. From wherein I crossed into Pakistan along with Baloch Sub Nationals and after about an hour or so I was apprehended by the Pakistani authorities in Pakistan.

Basically the movement into Pakistan for me was, I was on a visa and official visa in Iran and I was moving with my passports so I carried my passports with till the border almost so that if Iranian authorities or Iranian people who are about to check me or I am stopped or checked I should have a legitimate reason for movement with in Iran and my subsequent movement into Pakistan and then backwards. While I was not intending to having being caught so on my movement backwards again I would have had a legitimate reason to go about, With that passport with the legitimate visa of Iran.

During my judicial proceedings which were held under the field General court martial, I was accorded a defense council by the officials here which were conducting the entire proceedings.

Today I genuinely after the time having spent in Pakistan I feel very ashamed and I genuinely seek pardon of the acts and sins and crimes I have committed here against the Nation and the people of Pakistan.

end