Special Report by J. Choudhry/ISLAMABAD:

The OPEC crude oil has further dropped to 70 dollars a barrel yesterday in OPEC markets, a development that seems good for the consumers in Pakistan and other countries. With consistent decline in crude oil prices, the federal government has decided to further reduce domestic oil prices from Dec 1, 2014, to pass on relief to the consumers.

The Organisation of Petroleum Exporting Countries (OPEC) seem worried about the consistent decline in the crude oil prices because of less than expected demand in international markets and the use of gas by the consumers in some developed countries, including the United States.

Pakistan is expected to save a huge amount of more than three billion dollars in the import of crude oil and petroleum products in the ongoing financial year 2014-15 because of more than 28 percent decline in the crude oil prices in the OPEC countries. A few months back, the crude oil price in OPEC market was fluctuating from 105 to 108 dollars per barrel, but on Nov 28, 2014, crude oil price tumbled to $70 per barrel.

This gradual but steady decrease in crude oil price would be beneficial for Pakistan in the shape of a minimum of 3 to 3.5 billion dollars relief in import bill of crude oil and POL products in this financial year. Pakistan spends a big amount of about 15 billion dollars a year on the import of crude oil and petroleum products.

In a recent meeting with the Finance Minister the officials of the oil marketing companies and oil refineries told Ishaq Dar that Pakistan imports crude oil and oil products worth $15 billion. The oil stocks in the country are maintained for at least 30 days consumption.

Another advantage, the country would see is slump in pressure on the dollar-rupee exchange rate that currently is prevailing around 102 rupees in the open market today.

Pakistan would also see improvement in the trade deficit in 2014-15 because crude oil and POL products consume almost 40 percent of the total imports bill. Traditionally Pakistan faces 18 to 20 billion dollars trade deficit in a year and in this financial year this deficit is expected fall below 18 billion dollars that would have significant positive impact on the current account deficit.

The government had reduced petrol prices by about 12 rupees per liter in two phases and the recent cut in domestic petrol price was substantial, around 9 rupees that is the result of a significant decrease in crude oil prices in the OPEC markets. From Dec 1, 2014, the federal government again has announced further reduction in petroleum products prices to provide relief to the consumers.

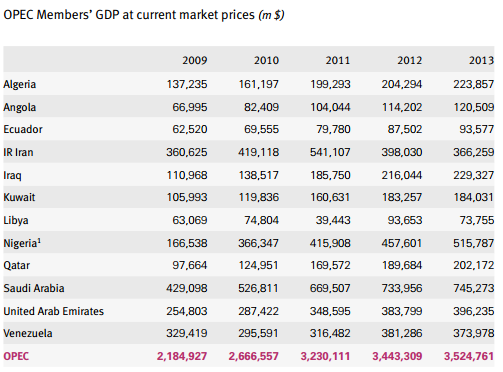

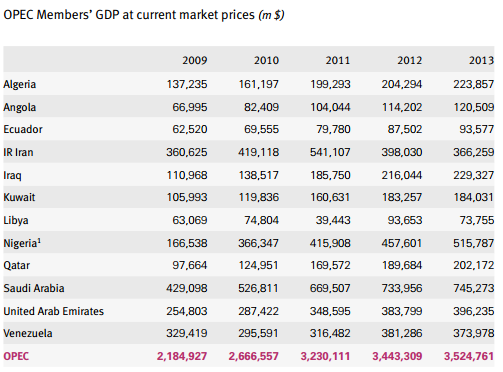

Black Gold balloons OPEC countries GDP by $1339 billion

Crude oil and other petroleum products known as Black Gold all over the world have not only changed the fate of key members of the Organisation of Oil Exporting Countries (OPEC) but also ballooned their Gross Domestic Product (GDP) by 1339 billion dollars in just four years, from 2010-2013.

Global spike in the prices of crude oil and petroleum products magnified the GDP of major oil exporters like Saudi Arabia, Nigeria, United Arab Emirates, Iraq and Qatar during this period.

For example, in 2009 the size of the GDP of Saudi Arabia was 429 billion dollars that had increased to 745 billion dollars by the year 2013, showing a substantial increase of 316 billion dollars in the GDP of the Kingdom of Saudi Arabia in four years.

In 2009 UAE’s GDP was at 255 billion dollars that had mounted to 396 billion dollars, while Nigeria showed the biggest increase in the GDP that increased from 166 billion dollars in 2009 to 516 billion dollars in 2013, showing 350 billion dollars or about 140 percent growth in Nigerian GDP.

Despite war and bomb blasts, the GDP of Iraq had increased more than 100 percent during this period and increased to 229 billion dollars from 110 billion dollars in this period.

However, Iran is the only country in the OPEC groups whose GDP increased from 390 billion dollars to over 514 billion dollars in couple of years after 2009, but in 2013 the Iranian GDP ended flat, at 366 billion dollars when it is matched with the size of 2009 GDP.

Qatar also showed an impressive increase in its GDP that surged from mere 97 billion dollars in 2009 to 202 billion dollars in 2013, mainly because of spike on world oil prices.

The OPEC members GDP was at 2184.83 billion dollars in 2009 that ballooned to 3524.76 billion dollars in 2013, showing an unbelievable increase of more than 1339 billion dollars increase in just four years period.

2004 _ Era of SPIKE in Crude Oil Prices

From the mid-1980s to September 2003, the inflation adjusted price of a barrel of crude oil on NYMEX was generally under $25/barrel. Then in 2004 the price rose above $40/barrel and then increased to $50. A series of events led the price to exceed $60 by August 11, 2005, and then the price exceeds $75 in the middle of 2006.

The crude oil prices then dropped back to $60/barrel by the early part of 2007 before rising steeply again to $92/barrel by October 2007 and $99 per barrel for December futures in New York on November 21, 2007.

Throughout the first half of 2008, oil regularly reached record high prices. On February 29, 2008, oil prices peaked at $103.05 per barrel and reached $110.20 on March 12, 2008, the sixth record in seven trading days. Prices on June 27, 2008, touched $141.71/barrel, for August delivery in the New York Mercantile Exchange (after the recent $140.56/barrel), amid Libya‘s threat to cut output, and OPEC‘s president predicted prices may reach $170 by the Northern-summer.

The most recent price per barrel maximum of $147.02 was reached on July 11, 2008. After falling below $100 in the late summer of 2008, prices rose again in late September. On September 22, oil rose over $25, to $130 before settling again to $120, marking a record one-day gain of $16. Electronic crude oil trading was temporarily halted by NYMEX when the daily price rise limit of $10 was reached, but the limit was reset seconds later and trading resumed.

The global economic meltdown caused a setback to the crude oil that fell much below 70 dollars/barrel, but from 2009 the OPEC and other oil exporting countries again jacked up prices to above 100 dollars/barrel during 2010-2014 (till March/April).

From May 2014, the OPEC crude oil prices starting losing ground and gradually fell to 78 dollars by Nov 6, 2014.